PropNex Picks

|May 21,2025Resale Condo Market Watch in April 2025

Share this article:

Slump in resale condo activity in April due to US tariffs and market uncertainties

Sales momentum in the resale condo market stalled in April, with 1,044 condo units worth nearly $2.11 billion being resold during the month - compared with the 1,173 resale transactions valued at $2.27 billion transacted in March.

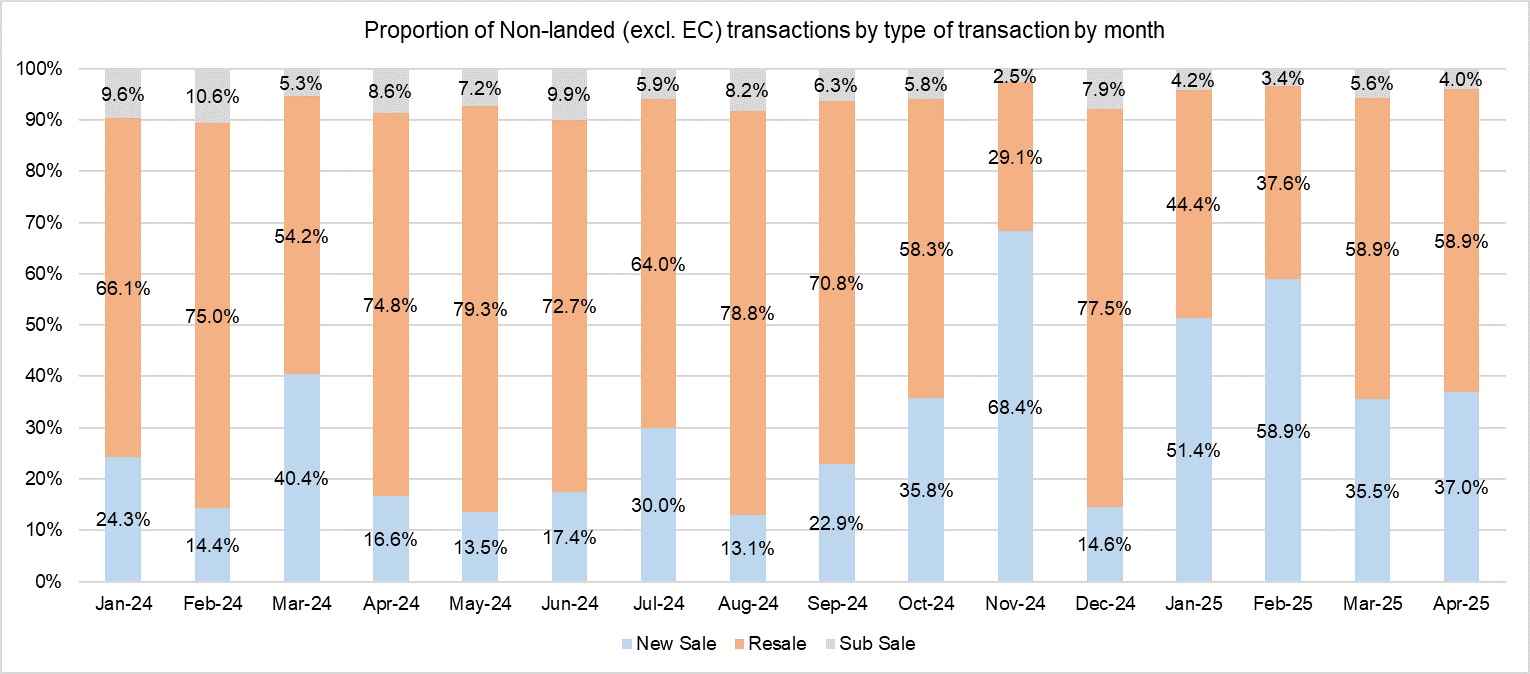

The decline in resale home market activity could have been due to the economic uncertainties and market volatilities spurred by the US liberation Day tariffs on 8 April. During the month, overall home sales activity saw a pullback as more buyers adopt a wait-and-see approach, opting to observe how the US-tariff situation would unfold before making any decisions. In April, new sales accounted for just 37% of non-landed transactions, while resale transactions accounted for more than half of transactions (59%, see Chart 1).

Chart 1: Proportion of private non-landed transactions (excl. EC) by sale type by month

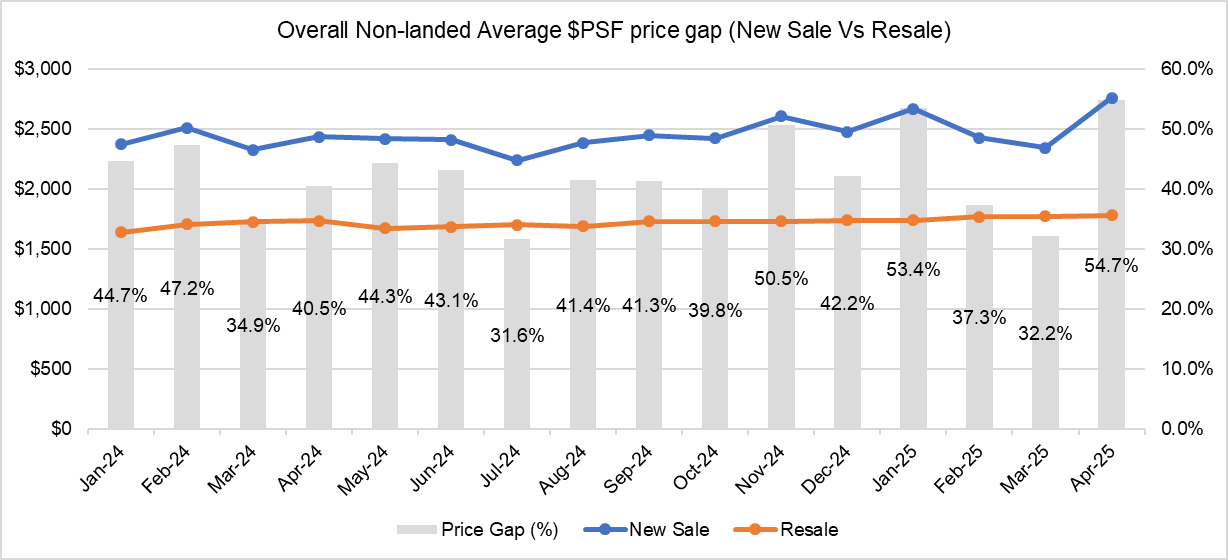

Due to the surge in city-fringe new launches from One Marina Gardens and Bloomsbury Residences during the month, the average unit price of new non-landed homes sold rebounded strongly after dipping for two consecutive months. The average new sales price jumped by 17.8% month-on-month (MOM) to $2,756 psf in April, while the average resale unit price inched up by 0.7% MOM. As such, the new sale and resale price gap expanded to 54.7% in April (see Chart 2). This is the widest the new sale-resale price gap has been since September 2023 when it stood at 61%.

Chart 2: New sale and Resale Price gap of non-landed homes (overall) by month

Uptick in profitability and winners

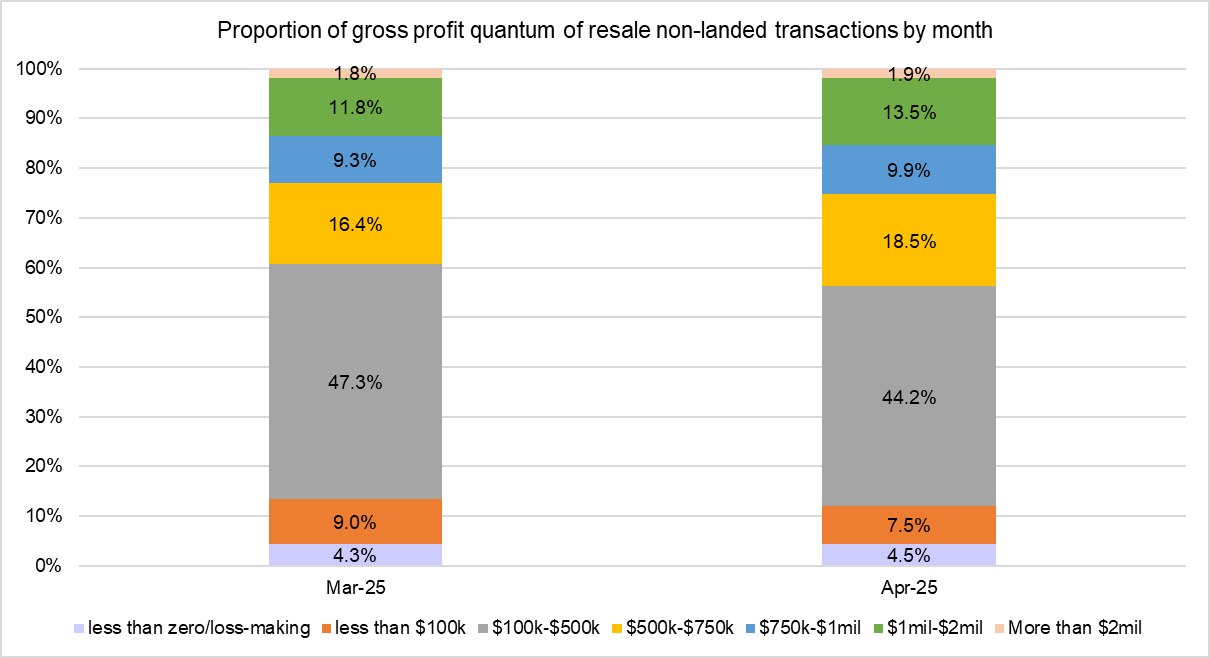

In terms of profitability, resale condo units transacted in April saw a pickup in gains compared with the previous month. Analysing the profits reaped by resale non-landed private homes in March and April 2025, it was found that resale condo deals garnered higher profits. That said, the proportion of loss-making transactions crept up in April 2025 over the previous month. The resale profit analysis involves computing gains achieved for the units by matching the condo resale transactions in April against their respective previous purchase price, according to caveats lodged.

The study showed that 15.4% of resale condo transactions (135 deals) in April made more than $1 million in profits, compared with 13.6% in March. Of these million-dollar profit-making deals, a substantial portion (36.5%) came from the Outside Central Region (OCR) homes (35.8%), followed by city fringe or Rest of Central Region (RCR), and Core Central Region (CCR) homes (27.7%). Loss-making deals in April accounted for 4.5% of transactions, ticking up from the 4.3% in March (see Chart 3).

Chart 3: Proportion of profit quantum of resale non-landed transactions (Mar 2025 vs Apr 2025)

The average profit was subsequently computed on a project basis. To minimise sampling errors, resale condominium projects that posted fewer than five transactions during the month are excluded from the study. Based on URA Realis caveat data analysed by PropNex Research, the most profitable condo in the CCR, was Horizon Towers in District 9, which pulled in an average profit of more than $1.1 million across five transactions in April. Horizon Towers was also the overall best performing project in terms of average profit quantum in April.

Top Resale Condo projects^ in terms of average gross profit* by region (April 2025)

Project Name | No. of transactions | Average Profit Gained ($) | Average Annualised Profit (%)# | Year completed | District |

CCR | |||||

| HORIZON TOWERS | 5 | $1,103,400 | 2.7% | 1984 | 9 |

| MARTIN MODERN | 5 | $595,314 | 3.3% | 2021 | 9 |

| D'LEEDON | 8 | $468,091 | 2.7% | 2014 | 10 |

RCR | |||||

| THE INTERLACE | 5 | $820,242 | 3.2% | 2013 | 4 |

| PRINCIPAL GARDEN | 7 | $640,857 | 3.9% | 2018 | 3 |

| DOVER PARKVIEW | 7 | $621,588 | 4.9% | 1997 | 5 |

OCR | |||||

| COSTA DEL SOL | 6 | $913,567 | 4.1% | 2003 | 16 |

| THE PANORAMA | 5 | $664,277 | 6.2% | 2017 | 20 |

| THE MINTON | 7 | $616,521 | 5.3% | 2013 | 19 |

In the RCR, the most profitable condo development in April was The Interlace, a project located in District 5, which achieved an average profit of over $820,000, across five transactions. In the heartlands or Outside Central Region (OCR), the most profitable project was Costa Del Sol in District 16 (Bedok, Upper East Coast) which garnered an average profit of $913,000 across six transactions.

Going by districts, resale homes in District 21 (Clementi, Bukit Timah) raked in the highest profits on quantum basis, with transactions reaping average gains of more than $894,000 per deal. In terms of annualised gains, resale homes in District 20 (Ang Mo Kio, Bishan) enjoyed an average annualised profit of 5% per deal.

Top 10 Resale Condo districts^ in terms of average gross profit* (April 2025)

District | No. of transactions** | Average Gains ($) | Average Annualised Gains (%)# |

D21 | 23 | $894,400 | 4.6% |

D10 | 72 | $788,950 | 2.5% |

D20 | 45 | $744,036 | 5.0% |

D15 | 88 | $727,161 | 4.3% |

D11 | 25 | $628,799 | 2.9% |

D16 | 61 | $553,890 | 3.9% |

D5 | 73 | $526,974 | 4.1% |

D9 | 71 | $519,504 | 1.8% |

D23 | 63 | $483,748 | 3.9% |

D3 | 63 | $457,024 | 3.5% |

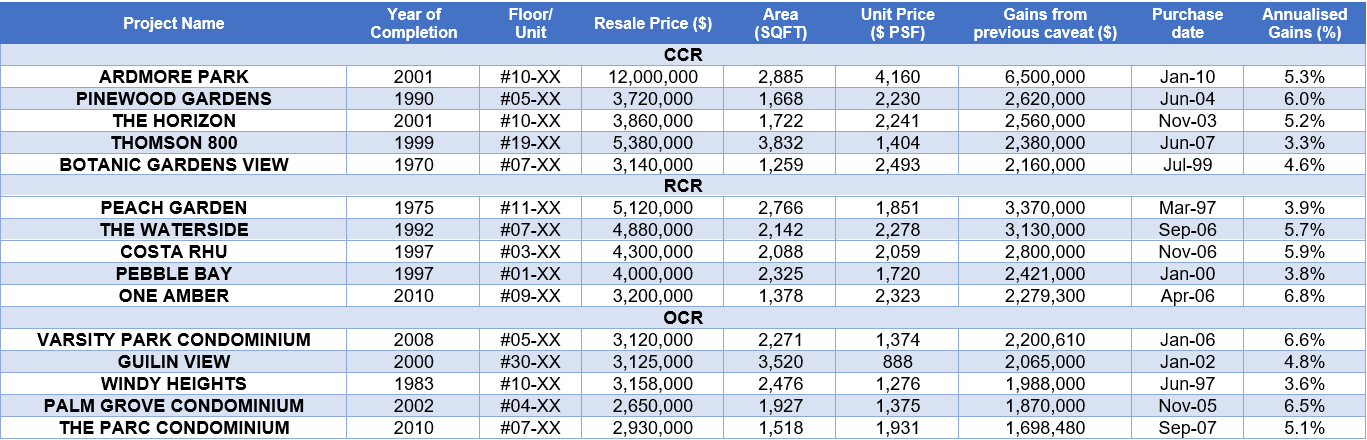

Analysing individual transactions by gross profit quantum, it was found that the top five gainers from each region ranged from $1.7 million to $2.6 million. The units which chalked up bigger gains were mostly sizeable large format condos that are more than 1,300 sq ft in size, and consisted mostly of older projects built in the 1980s to early 2000s. The respective holding periods for the most profitable resale properties were mostly beyond 10 years - the oldest being a unit held for 28 years.

Top 5 Resale Condo transactions in April 2025 by gross profit by region

It was found that the overall most profitable transaction and top gainer in the CCR was for an 10th floor unit at Ardmore Park. It was resold for an estimated profit of $6.5 million, reflecting an annualised profit of 5.3%. Based on URA Realis caveat data, the 2,885-sq ft unit was first bought in January 2010 and subsequently resold for $12 million in April 2025, with a holding period of 15 years. The freehold project in Newton was built in 2001, and it is situated close to Orchard Road.

The top gainer in the RCR in terms of gross profit was for unit transacted at Peach Garden in District 15, which fetched a gross profit of $3.37 million (annualised profit of 3.9%), based on caveats lodged. The 2,766-sq ft 11th floor apartment was sold for $5.12 million, with a holding period of more than 28 years. The freehold project in Marine Parade was built in 1975, and it is near to the Tanjong Katong MRT station on the Thomson-East Coast Line (TEL). Meanwhile, the surrounding commercial amenities include Parkway Parade Shopping Centre, Marine Parade Central Market and Food Centre, i12 Katong mall, as well as the East Coast Park.

Over in the OCR, the top gainer in April was a 5th floor unit located in Varsity Park Condominium in District 4. The 2,271-sq ft unit was sold for over $2.2 million, achieving an estimated profit of $2.2 million - which reflects an annualised profit of 6.6% over a holding period of about 18 years. The 99-year leasehold project was built in 2008 and it is located near to the National University of Singapore (NUS) and West Coast Park.

With rising new launch prices, condo resellers may stand to benefit as some homebuyers may find themselves priced out of the new launch market and could consider options in the resale segment. That said, resale gains may potentially see some moderation, particularly amidst the economic volatilities and uncertainties around how interest rates will move in the near-term.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.